Ah, nothing like a sudden jolt to the system! In early 2024, news broke that Chase Bank has closed seven branches across the country, sending shockwaves through various communities. This decision isn’t just a blip on the radar; it lays bare the shifting sands of the banking industry. With customer behavior evolving faster than a TikTok trend, financial institutions are scrambling to keep up with the digital revolution. So, what’s really behind this wave of branch closures, and what does it spell for customers seeking that human touch in an increasingly impersonal world?

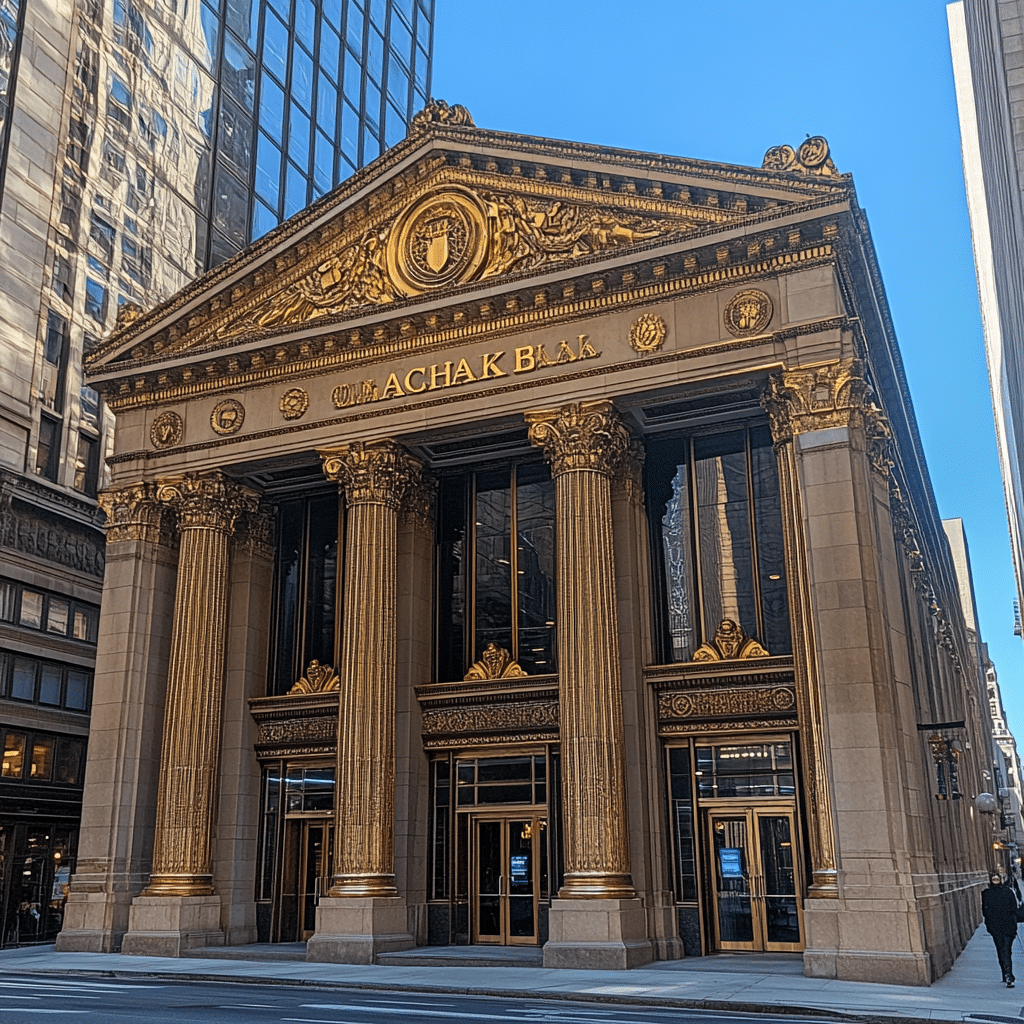

An Overview of Chase Bank’s Recent Closures

Chase’s closure of its branches isn’t a random act; it’s a calculated response to the growing preference for online banking services. Customers have diverse opinions—some feeling a nostalgic attachment to in-person interactions while others do a little happy dance as they embrace digital convenience. The seven branches hitting the chopping block are scattered across vibrant cities like San Francisco, New York City, and Miami, where the reliance on personal banking is palpable.

From the iconic streets of Manhattan to the sunny shores of Miami, residents are now left to ponder the implications of these closures. Questions arise regarding how local businesses will access banking services, prompting customers to advocate for enhanced digital alternatives. As the community banks fade into the background, the push towards technology seems more evident than ever.

Meanwhile, social media is buzzing with impacts. Reddittors are airing their grievances, while others are sharing their unexpected joys at learning a new online banking system. The more things change, the more they stay the same, right?

The Seven Bank Branches Impacted by Closure

A once-thriving hub for local businesses in the bustling financial district, its absence raises eyebrows among entrepreneurs. How do you place a price tag on the personal service that helped small businesses flourish for over a decade?

Ah, the melting pot of culture and commerce! With Manhattan’s branch closing, loyal customers may now be trekking miles to get their banking fix. Even hard-boiled New Yorkers are feeling this pinch, demanding quicker and better digital solutions to replace the personal touch.

Miami’s vibrant blend of cultures faces a hit, especially among the Latino population that values personal connection. It’s a reflection of a broader trend, leaving some demographics feeling unserved and neglected by traditional banks.

In the Windy City, where history intertwines with modernity, this closure ignites discussions about community banking. In a world growing colder and more digital, many wonder if the old traditions can survive.

Seattleites prove that the embrace of technology has redefined consumer desires. As mobile banking skyrockets, this closure serves as an indicator of shifting priorities among a tech-savvy population.

Dallas reflects a growing trend towards digital transactions, but what happens to the elderly or less tech-savvy individuals who still prefer a human lens on their finances? The closures leave a gap that raises pressing questions.

In this sprawling metropolis, the underserved communities bear the brunt of branch closures. Emergency funds and bank account basics can slip away faster than the latest fashion trend, spurring vital conversations about access and financial education.

The Future Landscape for Banking After Chase Bank Has Closed Seven Branches Across The Country

Alright, let’s fast-forward through the next few years! The alarming trend of Chase Bank closing seven branches across the country sets the tone for an inevitable shake-up in the banking system. With digital banking on the rise, other banks will likely reconsider their physical presence. It’s not just a game of musical chairs; it’s a full-blown dance-off between digital convenience and traditional banking.

What This Means for the Banking Sector

Dunking into tech? Banks are ramping up their digital offerings, steering away from brick-and-mortar locations. Chase’s investment is likely to shift to mobile platforms where banking is as easy as scrolling through Instagram.

Amid shifts, issues like the Capital One Bank settlement in 2025 linger. For those wondering, capital one settlement 2025 payout date dances tantalizingly close as it overlaps the realms of banking and consumer protection.

As banks digitalize, customers need to catch up! Providing educational resources is crucial—especially for older folks still navigating their way through the maze of bits and bytes.

Remember, branch closures can send economic ripples through local communities. Businesses craving face-to-face interactions risk losing out on valuable support, making localized banking still relevant for many.

Reduced physical presence may prompt regulators to step up their game, ensuring everyone gets a taste of banking accessibility. Underserved communities could see newfound support as other institutions take notice of the aftermath.

The Broader Impact of Bank Closures

Here’s where things get real. In a world where corporate players like Verizon are grappling with scrutiny over their own settlements, consumer vigilance is a must. The Verizon settlement payout date has become a talking point, weaving lessons about customer treatment into a narrative that consumers must heed.

Crossing into other waters, when thinking about capital one bank settlement 2025 how much will I get, it’s clear customers are staring hard at who handles their finances. This highlights a larger shift: technological banking options that deliver efficient transitions but could potentially lack the human touch.

As Chase Bank paves this path, communities must redefine their relationship with their banking strategies. The trends of today present both trepidation and the promise of innovation in how banking services evolve in engaging and creative ways.

Navigating the Future of Banking

The banking landscape is undeniably changing. As traditional branches thin out like a fashionista’s trendy wardrobe, institutions like Chase face the necessity of evolving. Predicting what’s next could be as complicated as choosing the perfect outfit for a night out—one needs to balance style, comfort, and the overall experience.

While the future is as uncertain as a foggy morning in San Francisco, one mantra rings clear: customers are dialing into a tech-forward future that doesn’t compromise the essence of personal service. As the months roll out, the strategies banks employ to maintain customer loyalty will unfold, illustrating that digital banking isn’t just a choice; it’s the new norm, ready or not!

Chase Bank Has Closed Seven Branches Across the Country

The Shake-Up in Banking

In an unexpected move, Chase Bank has closed seven branches across the country, spurring curiosity about what’s next for the financial giant. This closure is a part of a broader trend in which banks are reevaluating their physical presence in a digital-first world. Interestingly, as of now, many are looking at How many days Until spring, eager for the season of renewal and fresh starts, perhaps just like the banking sector is hoping for its own.

The closures come at a time when many consumers are shifting their banking habits towards online services, often bypassing physical branches altogether. Just like a dedicated fan might join the Mm2 club to stay updated on their favorite trends, patrons are now navigating their banking needs through apps and websites. This shift raises questions about the long-term effects on local economies and jobs, offering an intriguing avenue for discussion on platforms like Reddit, where Redditor Updates spark passionate conversations about such national changes.

What’s Next for Chase?

With these closures, whispers abound about what this means for Chase’s future and customer service innovations. Could we see a rise in mobile banking features, akin to following the latest buzz surrounding popular shows? Many are asking how many seasons of Suits are there, drawing parallels between evolving narratives in entertainment and banking. Innovations could mirror the excitement we feel when a new, groundbreaking player emerges in a popular sport, much like how a sake basketball player might redefine expectations on the court.

As clients consider their next steps, including potential new banking options, they may want to test their financial literacy akin to taking a personality disorder test. It might be worth pondering how these changes affect them personally. Meanwhile, rest assured, Chase will continue to streamline its services and navigate this shifting landscape, proving that while some may tread lightly—just like fans of the no step on Snek culture—the banking sector is ready to leap forward. After all, in a world that’s always adapting, just like the tale of a big truck powering through tough terrain, Chase is sure to find a way to stay relevant and engaged with its customer base.

In summary, while Chase Bank has closed seven branches across the country, the implications of this decision ripple throughout the financial sector and beyond. The shift towards digital may herald exciting changes, and as customers, we’ll see how this affects our daily lives—just as we find fresh perspectives within trending topics, from banks to pop culture.