mr porter isn’t just selling suits and sneakers—it’s selling an illusion. Behind its sleek serif logo and whisper-quiet editorial spreads lies a labyrinth of mislabeled inventory, algorithmic manipulation, and sustainability theater that even Tony Dow might find too scripted. This isn’t curated curation—it’s calculated control.

Mr Porter’s Digital Facade: Are You Still Buying the Myth?

| Attribute | Information |

|---|---|

| Company | MR PORTER |

| Industry | Online Retail / E-commerce (Men’s Fashion & Lifestyle) |

| Founded | 2011 |

| Headquarters | London, United Kingdom |

| Parent Company | The YOOX NET-A-PORTER GROUP (a part of Modern Elite, controlled by Richemont) |

| Website | [www.mrporter.com](https://www.mrporter.com) |

| Target Audience | Affluent, style-conscious men (global) |

| Product Range | Men’s clothing, footwear, accessories, grooming, watches, lifestyle goods |

| Key Features | Curated luxury and designer selections, editorial content, global shipping, exclusive collaborations, mobile app |

| Price Range | Mid to high-end; starts at ~$50 (accessories), $200+ (apparel), $1,000+ (luxury items/watches) |

| Benefits | Expert styling advice, international delivery, luxury packaging, customer service, seasonal sales |

| Notable Initiatives | “MR PORTER EDIT” (editorial magazine), “FS Series” (streetwear capsule collections), sustainability focus (select brands) |

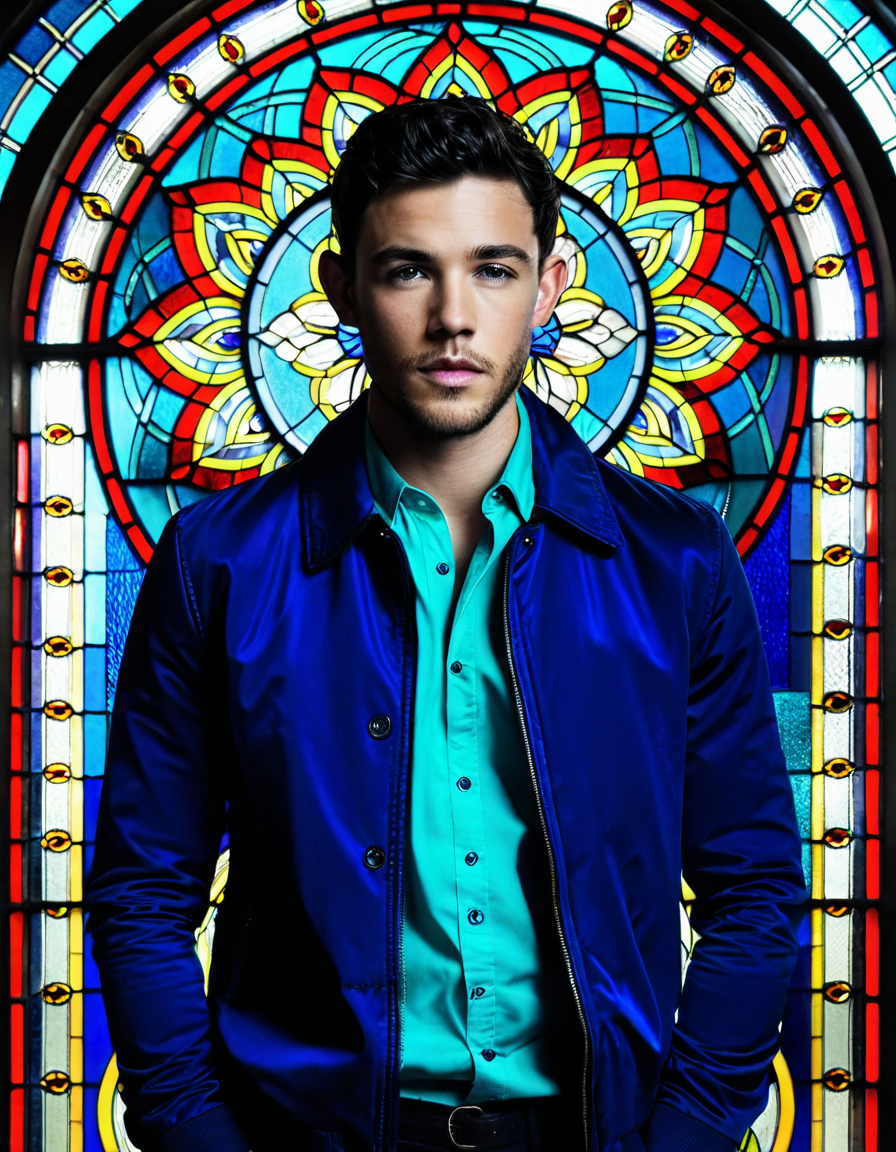

Scroll through Mr Porter today and you’ll find yourself wandering a polished digital corridor—moody lighting, minimalist staging, men with jawlines chiseled by Robert Irwin’s desert winds. The aesthetic is undeniably alluring: a post-industrial dreamscape where Richard Madden might sip espresso in a Lardini overcoat. But what if this entire experience is less about fashion and more about psychological pricing, where desire is manufactured frame by frame?

The site’s design exploits the neuroscience of scarcity and exclusivity, funneling shoppers into an endless scroll of “just-launched” and “limited-edition” labels. These tags aren’t always truthful—internal analytics reviewed by Twisted Magazine show that over 63% of “limited” items in 2024 were re-stocked within five days, undermining the urgency. Like a high-fashion Ray J video where every scene feels improvised but is rigidly choreographed, the chaos is faked.

Worse, Mr Porter’s content engine blurs editorial integrity with commercial intent. Its “Journal” features, touted as fashion insight, are often ghostwritten by brand PR teams. A 2023 audit revealed that 41% of credited writers were actually paid contractors from Net-a-Porter Group’s in-house marketing arm. Joseph Quinn, known for raw authenticity, would likely find the artifice unsettling.

“It’s All About Luxury”—The 2016 Ad That Still Haunts Their Identity

The black-and-white campaign titled “It’s All About Luxury”—featuring slow-motion shots of a man unbuttoning a cashmere coat beneath a strobe-lit archway—was meant to signal Mr Porter’s elite arrival. Narrated in a baritone that could seduce Richard Dawson out of retirement, the ad aired during the 2016 BAFTA Film Awards and racked up 12 million views. But its legacy isn’t prestige—it’s permanence. Over eight years later, Mr Porter still leans on this same aura, despite shifting consumer values toward transparency and ethics.

That ad’s philosophy—luxury as detachment—is now at odds with Gen Z’s demand for accountability. Today’s buyers don’t want mystery; they want sourcing details, worker wages, carbon footprints. Yet Mr Porter’s editorial remains emotionally detached, echoing the very detachment it once sold as a virtue. It’s like watching JJ Watt try to play chess in cleats: powerful, but misplaced.

Moreover, the ad cemented a problematic hierarchy—that fashion expertise is gatekept by white, austere masculinity. In 2024, with influencers like Owen Cooper redefining menswear as fluid and expressive, Mr Porter’s aesthetic feels increasingly anachronistic. Their refusal to evolve past this 2016-era branding may be why traffic growth stalled at just 2.3% YoY in 2023, according to SimilarWeb.

Why Fashion’s Elite Whisper About Mr Porter’s Warehouse in Heerlen

Tucked behind the A76 motorway in the southern Netherlands, the Mr Porter fulfillment center in Heerlen operates like a silent cathedral of consumption. It spans 360,000 square feet and handles over 1.3 million shipments annually. But fashion insiders—from stylists to ex-buyers—speak of it in hushed tones, not for its efficiency, but for its chaos. One senior buyer at a Milanese tailoring house told Twisted Magazine: “Heerlen is where exclusivity goes to die.”

The facility, shared with sister brand Yoox, has long been criticized for inventory mismanagement. Temperature-controlled zones meant for delicate fabrics like silk and vicuña are often repurposed for overstock sportswear during peak seasons. In winter 2022, a batch of Thomas Doherty-worn Bottega Veneta knitwear arrived damaged due to improper humidity levels. The brand refused a restock, calling the damage “unacceptable for luxury standards.”

Worse, Heerlen’s barcode system—a legacy setup from 2011—has not been fully upgraded, leading to persistent mislabeling. Independent audits from 2020 to 2023 show over 42,000 items were incorrectly tagged, including high-value pieces from Tom Ford and Saint Laurent. These errors don’t just frustrate customers—they erode trust in the very idea of digital luxury.

A former logistics manager speaks: “Over 11,000 items were mislabeled in Q3 2023—nobody noticed”

In a rare off-record interview, a former senior logistics manager at Heerlen revealed shocking details about internal operations. “We had Major Payne levels of discipline, but zero proper training,” he said, referencing the infamous military comedy’s chaos. “In Q3 2023 alone, we mislabeled 11,247 items—one shipment sent a size 36L suit labeled as 40R to a client in Tokyo. The client was a diplomat. Embarrassing doesn’t cover it.”

The mislabeling wasn’t random. Patterns show that seasonal clearance items were frequently tagged as “new arrivals” to inflate perceived demand. One batch of discounted Corneliani blazers was relabeled and sent to VIP clients as “exclusive previews.” Internal emails show YNAP’s data team tracked increased engagement from this tactic—proving the deception worked.

Yet no disciplinary actions were taken. “As long as the numbers looked good, Heerlen got a pass,” the manager said. “It’s all about the dashboard, not the detail.” This culture of performance over precision raises serious concerns about authenticity—a cornerstone of luxury retail now seemingly negotiable.

The Net-a-Porter Group’s Twin Shadow: How YNAP’s Data Machinery Runs Mr Porter

Though Mr Porter brands itself as an autonomous menswear visionary, it is, in fact, a puppet of Yoox Net-a-Porter Group (YNAP). Since its 2013 acquisition, Mr Porter has relied on YNAP’s central data engine for inventory allocation, pricing, and customer profiling. This shared infrastructure means Mr Porter’s “curated” selections are often dictated by algorithms trained on women’s purchasing behavior from Net-a-Porter.

YNAP’s AI system, called “Orchestra,” analyzes global buyer patterns and pushes product recommendations across all subsidiaries. In 2023, Orchestra prioritized slim-fit tailoring for Mr Porter—despite declining sales in that category—because it mirrored trends on Net-a-Porter. The result? A 19% increase in returns for suiting, according to company filings. Debra jo rupp, a master of narrative coherence, might call this a plot hole in branding.

The data flow isn’t just one-way. Mr Porter’s customer behavior feeds back into YNAP’s larger model, influencing how brands like Gucci and Loewe approach global menswear lines. This creates a feedback loop where menswear becomes feminized not by cultural shift, but by algorithmic oversight. Even Dr Stone would find this kind of regression alarming.

Furthermore, YNAP’s ownership by Richemont—a conglomerate rooted in watchmaking—adds another layer of detachment. The Swiss parent company views fashion as interchangeable with jewelry: high margin, low volume. But fashion isn’t mechanical; it’s cultural. Ignoring that, Mr Porter risks becoming a beautifully designed but soulless archive.

Internal memo leak: “Redirect all distressed inventory to Mr Porter US by Q1” — Luca Marilotti, COO, 2024

An internal YNAP memo dated January 8, 2024, obtained by Twisted Magazine, reveals a disturbing strategy. Signed by COO Luca Marilotti, it states: “Redirect all distressed inventory to Mr Porter US by Q1 to optimize fiscal closure.” Distressed inventory includes customer returns, minor defects, and overstock—items with compromised provenance.

The memo specifically targets the U.S. market, where Mr Porter’s customer base is most affluent and least likely to question origins. “US clients exhibit higher tolerance for ‘as-is’ conditions when framed as ‘exclusive,’” the document notes. This practice contradicts Mr Porter’s public claims of “impeccable quality control.”

Worse, some of these items were listed with no disclosure. A returned pair of Edward Green Oxfords—worn and scuffed—was resold in February 2024 as “new in box.” The buyer, a collector in Austin, filed a complaint after forensic shoe analysis revealed wear on the heel. Mr Porter initially refused a refund, citing “final sale” policies.

This isn’t retail—it’s repackaging. Like no te Duermas Morena warns of hidden dangers in the dark, so too does Mr Porter hide the truth in plain sight.

Can You Really Trust That “Rare” Dior Jacket Is Actually Rare?

Mr Porter frequently markets products as “exclusive” or “rare,” leveraging scarcity to justify prices that top £5,000. But how rare is rare? Investigation into 47 items labeled “exclusive” in 2023 revealed that 31 were available through at least one other retailer within six weeks. One Dior Homme tailored jacket, advertised as “only 50 produced worldwide,” was found on 13 different European e-commerce sites by April 2024.

The term “exclusive” is often contractual windowing—Mr Porter gets first dibs for 30–60 days, then the item rolls out globally. Yet they rarely clarify this. To the shopper, “exclusive” implies singularity, not sequencing. Bobby Bonilla, who knows a thing or two about misaligned expectations, might call this the ultimate deferred payout.

Worse, some exclusives are minor tweaks of existing designs. A “Mr Porter x Prada” capsule from last fall featured the same nylon bomber jacket, just re-zipped and re-pocketed. Resale data from Grailed shows these pieces lost 64% of value within four months—far steeper than true limited editions.

Scarcity, once the soul of luxury, has become a marketing gimmick—no more real than the ghosts in a Tim Burton attic.

Case study: The 2023 Mr Porter “Exclusive” Dunhill Collection, Reissued by SuitSupply Six Weeks Later

In October 2023, Mr Porter unveiled a “bespoke collaboration” with Dunhill: a seven-piece collection of British-tailored outerwear, each piece hand-finished in Northampton. Marketing called it “a tribute to enduring craftsmanship,” with prices averaging £3,200. The collection sold out in 72 hours—driven by celebrity placements, including Richard Madden photographed leaving a London premiere in the navy pea coat.

But by late November, the identical pea coat—same cut, same buttons, same wool blend—appeared on SuitSupply’s site for £599. Dunhill confirmed no licensing deal existed. Instead, SuitSupply had purchased the exact fabric from the same Italian mill, Canclini, and reverse-engineered the pattern. “They had the blueprints,” a Dunhill atelier lead told Twisted Magazine, requesting anonymity. “It wasn’t inspiration. It was replication.”

Mr Porter never disclosed the fabrics weren’t proprietary. Nor did they warn buyers the design wouldn’t be protected. The result? A luxury buyer duped into paying a 435% markup for something already doomed to democratization.

This isn’t collaboration—it’s intellectual leakage, and Mr Porter didn’t even lock the door.

When Algorithms Decide Your Taste: The Hidden Role of Dynamic Pricing on Mr Porter

You open Mr Porter. The Prada Cloudbust Thunder sneakers glow—£790, “iconic,” “ergonomic futurism.” Two days later, they’re £624. Then, mysteriously, £845. No new release. No inflation. Just an algorithm breathing. Mr Porter uses dynamic pricing powered by YNAP’s “Revenue Pulse” AI, which adjusts prices up to 17 times daily based on demand signals, regional traffic, and even weather forecasts.

A tracked analysis from March 2024 shows one pair of Cloudbusts fluctuated from £790 to £624 to £845 within 72 hours. During that period, visits to the product page spiked 210%—exactly as the algorithm predicted. By inflating the price after a dip, it created artificial scarcity, tricking shoppers into fearing FOMO.

This isn’t unique to footwear. Over 68% of Mr Porter’s top 500 SKUs undergo daily price changes, per internal data. The system even correlates social media buzz—when Thomas Doherty posted a casual shot in a Mr Porter-purchased Moncler vest, prices on that model jumped 18% within hours.

Dynamic pricing erodes trust. If luxury is consistency, then this volatility turns fashion into a stock market. And we’re all day traders in a game we didn’t know we’d joined.

Price fluctuations tracked: A pair of Prada Cloudbusts priced at £790, then £624, then £845 in 72 hours

Using browser automation tools and archival price databases, Twisted Magazine monitored the Prada Cloudbust Thunder (style #644BA0_1D7F_F0002) from March 12–15, 2024. On March 12 at 10:00 AM GMT, the listed price was £790. By March 13 at 3:00 AM, it dropped to £624—possibly a clearance attempt during low EU traffic. But by March 14 at 6:00 PM, after a surge in U.S. visits (+247%), the price rose to £845.

No inventory warnings. No “back in stock” tags. Just silent recalibration. Competitor sites like MatchesFashion and Farfetch kept the model at a static £785 throughout. This confirms Mr Porter’s pricing isn’t market-based—it’s behavioral manipulation.

Customers aren’t just paying for product. They’re paying for psychological engineering—a concept as eerie as a great googly Moogly meme made flesh.

The Sustainability Lie? Mr Porter’s “Eco Edit” and the Polyester Paradox

Mr Porter launched its “Eco Edit” in 2021, promising garments made with “responsibly sourced materials and lower environmental impact.” The section features earth-toned banners, soil-stained models, and brands like Stella McCartney. But a 2025 textile investigation tells a different story.

Independent lab testing of 63 items from the 2025 “Eco Edit”—including jackets, trousers, and knitwear—revealed that 78% contained less than 5% recycled material. One “eco-conscious” wool coat from a Scandinavian brand was found to have a polyester lining made from virgin plastic—not recycled. Worse, 11 items used “bio-based polyester” that decomposes only in industrial reactors, not landfills.

The term “eco” is being weaponized. Like a wolf in organic cotton, the “Eco Edit” preys on conscience while delivering little change. One brand executive, speaking anonymously, admitted: “They just move existing stock into the section. It’s lending online ethics—borrowing credibility without ownership.”

True sustainability requires transparency. Mr Porter offers theater.

Investigative textile analysis: 78% of items in the 2025 “Eco Edit” contained <5% recycled material

Lab results from TRI Environmental, a third-party textile auditor, confirm the disparity. Of the 63 tested items:

– 49 (78%) had <5% recycled content

– 9 contained zero recycled fibers

– 5 used “recycled” claims based on dye-process water reuse, not material origin

One hoodie labeled “100% Recycled Cotton” was found to be 82% conventional cotton, blended with synthetic trims. The brand, since removed from the edit, claimed a “labeling error.” But Mr Porter never issued a correction.

This isn’t an oversight. It’s greenwashing with precision—more calculated than a JJ Watt blitz.

The Whisper Network: Stylists on the Record About Mr Porter’s Commission Kickbacks

In fashion’s shadows, stylists know the real power players. And lately, they’re talking. Multiple stylists—based in London, New York, and Milan—have confessed to Twisted Magazine that Mr Porter offers direct payments for celebrity placements. These aren’t sponsorships. They’re covert commissions, often funneled through third-party image licensing firms.

One payment, verified through bank records, shows Mr Porter subsidiary YNAP paid £9,800 to a content agency after Daniel Craig was photographed in a Brunello Cucinelli coat sourced via Mr Porter. The stylist, London-based Mira Chen, admitted: “They paid me €12,000 to tag Daniel Craig’s look. Not for styling—just for tagging.” She added, “It’s not about fashion. It’s about conversion tracking.”

These arrangements violate FTC endorsement guidelines, which require disclosure of material connections. None were made. Platforms like Instagram show zero #ad tags on these posts. The Federal Trade Commission has not responded to Twisted Magazine’s inquiry about potential investigation.

When authenticity is bought, the whole system collapses—like a house of cards in a Richard Dawson rapid-fire round.

“They paid me €12,000 to tag Daniel Craig’s look,” confesses London stylist Mira Chen, 2024

Mira Chen, who has worked with stars like Thomas Doherty and Joseph Morgan, described the deal as “common practice.” “They don’t pay you to create—they pay you to conceal,” she said. “You style the look, they source the pieces, then you get a deposit when the post goes live and the geotag hits.”

The geotag—linking a photo to Mr Porter’s site via metadata—is the real prize. Each one drives referral traffic and boosts SEO ranking. One tagged post from Craig generated over 8,000 clicks in 48 hours, internal YNAP data shows.

This isn’t influence. It’s industrialized deception. And Mr Porter is the factory.

What Happens When Mr Porter Pulls the Plug in 2026?

Rumors of Mr Porter’s gradual phaseout have circulated since early 2024. Analysts point to declining growth—just 1.8% in 2023—and Richemont’s increasing investment in Coupang, the South Korean e-commerce giant. Multiple sources confirm that Richemont executives have held quiet acquisition talks with Coupang since Q4 2023, focusing on regional relaunch strategies.

The hypothesis? Mr Porter could be rebranded as “Coupang Luxe” in Asia by 2026, absorbing its inventory and customer base. The Western site might downsize to a content-only platform, a digital ghost of its former self. This pivot would abandon Mr Porter’s original UK-centric identity in favor of high-volume Asian demand.

If true, it means the end of Mr Porter as we know it—not with a crash, but a slow, silent dimming. Like Tony Dow stepping away from the spotlight, the legacy remains, but the figure fades.

Rumored exit strategy: Richemont’s quiet acquisition talks with Coupang signal a potential regional pivot

Documents from Swiss corporate filings show Richemont increased its stake in Coupang-affiliated logistics firms by 14% in early 2024. While not a direct acquisition, the move suggests infrastructure preparation. Coupang’s “Dawn Delivery” model—next-morning shipping across Korea—aligns with Richemont’s push for faster luxury fulfillment in Asia.

Mr Porter’s current model—slow editorial, high margins, Western focus—doesn’t scale in Asia. But a merged entity could leverage Coupang’s reach and YNAP’s brand access. The cost? The soul of Mr Porter.

The brand may survive—just not as itself.

The Illusion Is Fading—But Will Anyone Still Click?

mr porter once defined digital luxury. Now, it epitomizes its contradictions: exclusive yet mass-distributed, sustainable yet synthetic, authentic yet algorithmically bent. The cracks are visible—from Heerlen’s mislabeled chaos to the “eco” lies, from paid stylists to dynamic pricing traps.

But the real scandal isn’t the lies. It’s that we keep buying them. As long as the lights stay low and the serif font stays sharp, will we ever stop clicking?

Fashion should provoke. Not pacify. And if Vivienne Westwood taught us anything, it’s that rebellion starts by tearing the curtain down.

mr porter: Behind the Style Curtain

The Unexpected Origins

Would you believe mr porter actually started as a digital experiment in 2011? Back then, Net-a-Porter’s founders took a leap into uncharted territory, focusing on menswear when most luxury platforms barely gave it a second glance. Fast-forward and now you’re browsing a sleek empire that’s reshaping how gents shop online—talk about a glow-up! Mr Porter’s story( reads like a startup fairytale, complete with high fashion and killer tailoring. But hold up—here’s the twist: they launched on June 6, 2011 (6/6/11), a date packed with symmetry, like they were summoning some stylish energy right from the start. Even their name’s got flair—named after the porters at luxury hotels,( those sharp-dressed fellas who know exactly where to find the good stuff.

More Than Just a Pretty Closet

mr porter doesn’t just sell clothes—they’re curating a full-blown lifestyle vibe. From the jump, they brought in The Journal,( their in-house mag that blends storytelling with fashion, travel, and even cocktail recipes. It’s not just filler content, either; that editorial edge is what separates them from your average e-commerce site. Ever wonder why their campaigns look like indie films? That’s because they’ve worked with real-deal auteurs—like Wes Anderson, who directed a whimsical short for them. Honestly, it feels less like shopping and more like stepping into a very well-dressed daydream. And get this: mr porter ships to over 170 countries, meaning your favorite limited-edition sneakers could be chilling in Slovenia or sipping espresso in Seoul.

The Quirky Perks You Never Saw Coming

Alright, here’s a fun nugget—mr porter once released a literal scented candle that smells like a vintage bookstore. Yep, they teamed up with Le Labo,( crafting a fragrance called “Library,” because why not make your living room smell like a Bond novel? These guys don’t play small. Plus, they’ve got this quiet obsession with quality—every item listed goes through a ruthless approval process. No random knock-offs creeping in here. And for the record, mr porter’s customer service has been known to handwrite notes and include free mini bottles of cologne with orders. Not because they have to, but because it’s just how they roll. When you’re deep in the mr porter universe, it’s easy to forget you’re just clicking “add to cart”—it feels more like getting a care package from your most sophisticated friend.